Since March This Year, Tungsten Carbide Ring Price Has Surged

In the current metal market, tungsten is undoubtedly a shining star. With the recovery of the global economy and the rapid development of new energy and high-end manufacturing, tungsten, as an important strategic metal, has shown a strong growth trend in market demand. However, at the same time, the soaring tungsten price has also brought unprecedented challenges to related industries. For Guangdong Tefisen Technology Co., Ltd., a company that uses tungsten carbide rings in printing equipment, it has also felt the pressure of the tungsten carbide ring price.

According to data from Jintou Websie, tungsten prices have shown a steady upward trend since March of this year. On May 24, the price of 65% grade black tungsten concentrate reached 156.5K yuan per ton, an increase of 27.76% compared to 122.5K yuan per ton on January 2 of this year and an increase of 29.88% compared to 120.5K yuan per ton in the same period last year.

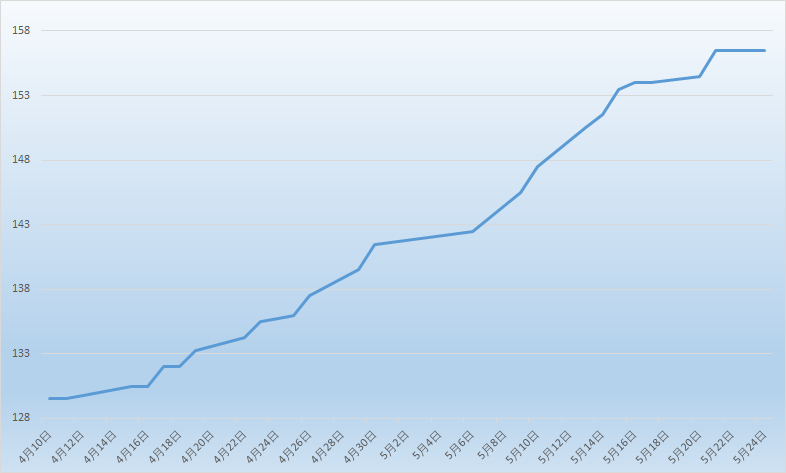

The one-month price trend chart of black tungsten concentrate from April 10, 2024 to May 24 (unit: 10K yuan/ton)

As can be seen from the chart, in just one month, from 129.5K yuan per ton on April 10 to today's price, the increase has reached 20.85%, showing a straight-line rise, with a daily increase of 1K yuan per ton.

Tungsten, known as the "teeth of industry", not only occupies an important position internationally but also symbolizes China's resource advantages. Public data reveals that China's tungsten ore reserves and production are among the top in the world, with tungsten ore reserves accounting for 47% of the global total and production reaching 84%. Its application fields are extensive, covering transportation, mining, industrial manufacturing, durable parts, energy, military, and other key areas.

The tungsten price has reached a decade-high, and the main reasons are as follows:

I. Supply-demand imbalance

The recent surge in tungsten prices is generally believed to be the result of the combined impact of both supply and demand. Especially the tightness in the supply side has become the main factor driving price increases. It is understood that there has been a significant decline in production on the supply side. In the first quarter of this year, the average monthly output of tungsten concentrate was around 7,500-7,800 tons, while the average monthly output in the same period last year was around 9,500 tons, representing a decrease of about 2,000 tons from the same period last year. The decrease in production was quite serious. At the same time, demand has not decreased significantly, and the contradiction between supply and demand has become prominent. In addition, the quota for tungsten concentrate has been reduced this year. On March 19, the Natural Resources Department issued a notification on the issuance of the total control indicators for tungsten mining (65% tungsten trioxide content) in 2024 (the first batch), with a total control indicator of 6.2 tons, involving 15 provinces such as Inner Mongolia, Heilongjiang, Zhejiang, and Anhui, which has also exacerbated the tense market situation.

II. The main producing areas of tungsten products have entered the environmental supervision month in May

Faced with the current situation of tight tungsten resource supply, improving the utilization rate of recycled tungsten resources is regarded as an effective way to alleviate the shortage. However, although China's tungsten recycling resource utilization industry is developing rapidly, the recovery and utilization rate is still lower than the global average of 35%. In the future, optimizing processing technology and improving the utilization rate of recycled tungsten resources are expected to significantly alleviate the shortage of raw materials in the tungsten industry chain.

III. The photovoltaic industry has increased the use of tungsten

With the increasing demand for tungsten wire production in the photovoltaic industry, domestic tungsten consumption has increased slightly overall. Diamond wire is mainly used for cutting hard and brittle materials such as crystalline silicon and sapphire, and is a core consumable in the material processing process. With the increase in silicon wafer size and thinning, the industry pursues finer wire diameters and higher efficiency in the cutting process. Traditional diamond wire uses carbon steel as the material, and tungsten wire diamond wire is expected to replace carbon steel diamond wire as the mainstream due to its higher temperature resistance, stronger tensile strength, and other physical properties.

As a manufacturer of printing consumables, Tefisen uses virgin materials (tungsten powder) to produce all its tungsten steel rings, which have a service life of 500,000 to 600,000 times. Naturally, good products come with relatively higher prices. However, on one side, the material cost is constantly rising, and on the other side, customers are demanding price reductions. Mr. Lin, the Engineering Director of Guangdong Tefisen Technology Co., Ltd., said that the printing equipment consumables industry is highly transparent and fiercely competitive, and enhancing the core competitiveness of the enterprise is the only way for sustainable development.